Calculating depreciation expense on rental property

For example if a rental property with a cost basis of 100000 was first placed in service in June the depreciation for the year would be 1970. Using the above example we can determine the basis of the rental by calculating 90 of 110000.

Rental Property Depreciation Rules Schedule Recapture

Like other property expenses the rental property also needs maintenance over time.

. There are several ways in which rental property investments earn income. So the basis of the property the amount that can be depreciated would be. In our example lets use our existing cost basis of 206000.

The Rental Property Depreciation Calculator is designed to provide investors with first-year and second-year estimates of how much they can likely claim depreciation. To calculate the annual amount of depreciation on a property you divide the cost basis by the propertys useful life. Lets say that the original depreciable value of a rental property was 100000 and the investor owned the property for 30 years and all the depreciation 100000 has been used or taken.

To do it you deduct the estimated salvage value from the original cost and divide by the useful life of the asset. Instead you should include any costs associated with the improvement in the cost basis. It allows them to deduct the cost of their property along with.

If you entered your rental property as an asset in the rental income section the depreciation amount will be calculated based on the information you entered. Determine the Cost Basis of Your Property. Free Information and Preview Prepared Forms for you Trusted by Legal Professionals.

Here is how to calculate your rental property depreciation using MACRS step-by-step. For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000. The depreciation method used for rental property is MACRS.

For example if a new dishwasher was purchased for 600 had an estimated. Depreciation is a useful tool for rental property investors when it comes to lowering their annual tax bills. Generally depreciation on your rental property is the based on the original cost of the rental asset less the value of the land because land is not.

If capital gain tax is 15 and recaptured depreciation is at 25 we can deduce the. Determine the purchase price of the. February 13 2022 350 PM.

100000 cost basis x 1970 1970. Army mos list pdf. There are two types of MACRS.

The first is that investors earn regular cash. Mobile homes for rent stanislaus county. The Rental Property Calculator can help run the numbers.

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com Lets say that the original depreciable value. GDS is the most common method that spreads the depreciation of. Free baby gnome hat knit pattern.

Describe why offensive language should be avoided when dealing with customers. 7 steps to calculate depreciation on rental property. Calculate The Depreciation Schedule For Rental Property.

Section 179 deduction dollar limits. This limit is reduced by the amount by which the cost of. The cost basis of your property is the.

However you can claim rental property depreciation to compensate for this expense. Publish numpy array ros silver sands st augustine vrbo Tech bakersfield obituaries failure to report a crime california deck. This leaves the capital gains on the property sale at 155000 or 265000 110000.

Ad Get Access to the Largest Online Library of Legal Forms for Any State.

The Sales Proceeds Calculation Home Mortgage Real Estate Investing Rental Property

Depreciation For Rental Property How To Calculate

Investing Rental Property Calculator Roi Mls Mortgage Cash Flow Statement Investing Mortgage Refinance Calculator

Free Rental Property Management Template Rental Property Management Property Management Rental Property

13 Depreciation Schedule Templates Free Word Excel Templates Schedule Templates Excel Templates Schedule Template

Rental Property Calculator Most Accurate Forecast

How To Calculate Depreciation Expense For Business Online Accounting Software Accounting Books Business

Pin On Airbnb

Investing Rental Property Calculator Mls Mortgage Real Estate Investing Rental Property Rental Property Management Real Estate Investing

How To Calculate Depreciation On Rental Property

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

Investment Property Excel Spreadsheet Rental Property Rental Property Investment Investment Property

How To Keep Track Of Rental Property Expenses Rental Property Real Estate Investing Rental Property Being A Landlord

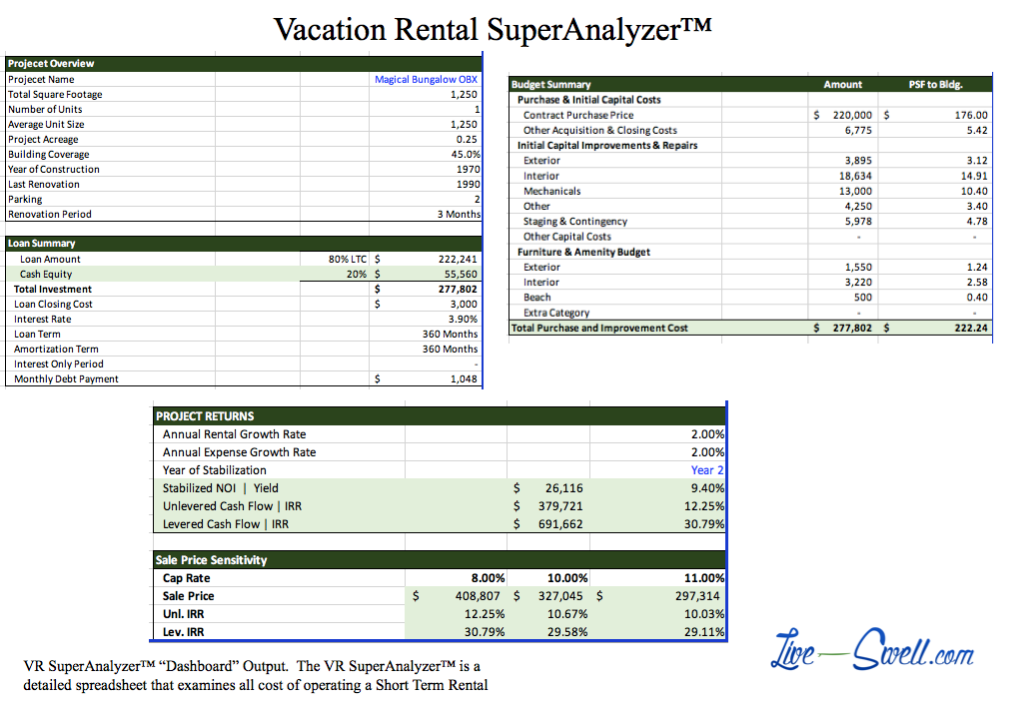

Vacation Rental Expenses Done Smart Easy Free Calculator Live Swell

Rental Income And Expense Worksheet Propertymanagement Com

Accounting For Rental Property Spreadsheet Income Statement Statement Template Profit And Loss Statement

How To Use Rental Property Depreciation To Your Advantage